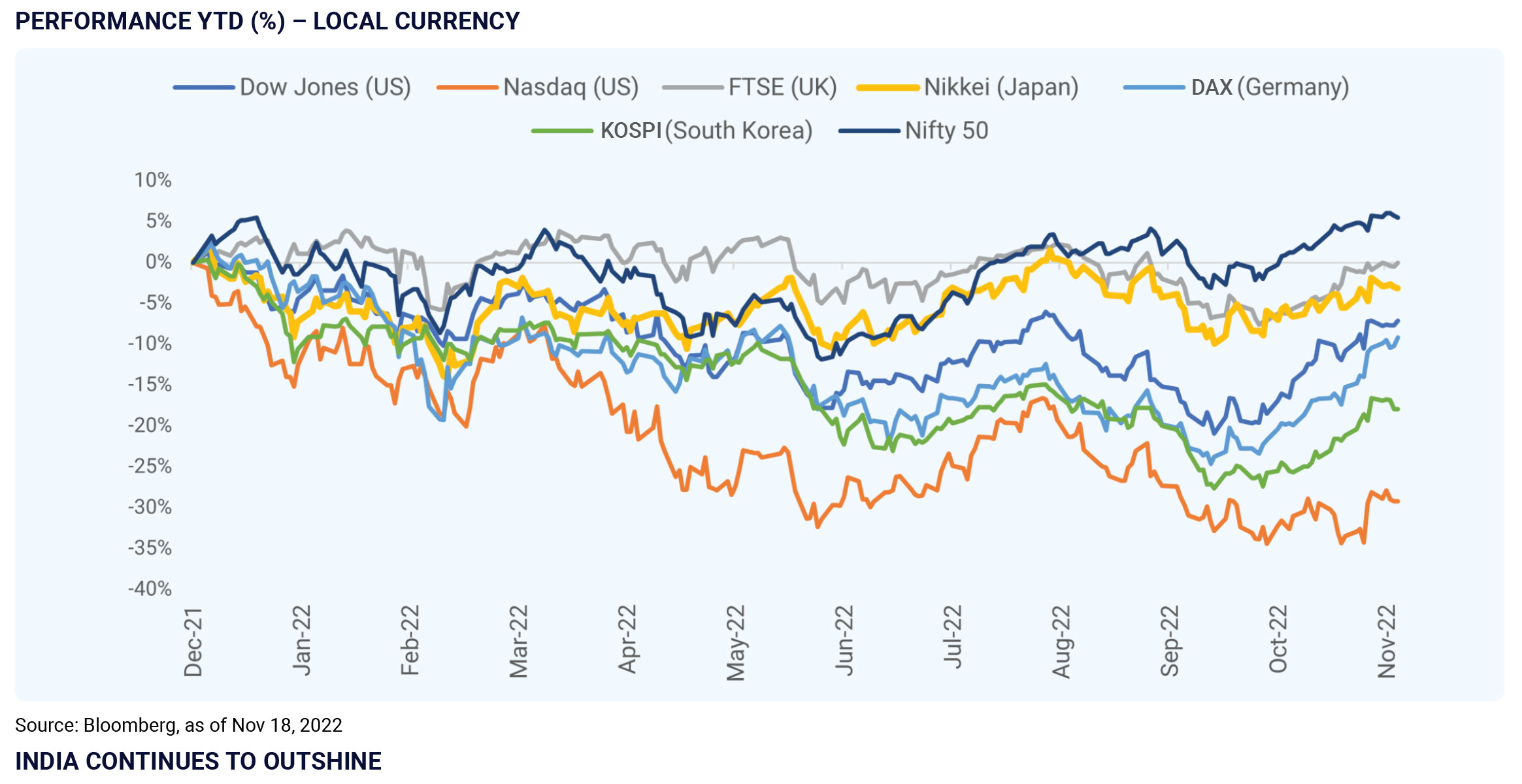

Indian equities have shown resilience during the year so far. While the sentiment is optimistic about the Indian market, midcaps continue to underperform.

Given the run-up in equities compared to most other major markets, the expensive valuation of Indian equities could prompt foreigners to pull money out

of India and move to cheaper markets. Also, for Q2FY23, the quarterly results have been a mixed bag. In the near term, markets could be volatile. Thereby,

investors can choose large caps over midcaps to minimise the downside risk in their portfolios.

From a long-term perspective, there is a global consensus that India will continue to grow faster than any other major economy. Domestic demand and

consumption would drive India’s growth. The limited dependency of Indian businesses on global supply chains or exports makes India an attractive

destination. At the same time, the China + 1 strategy of multinational corporations is likely to help India increase manufacturing activity