Indian debt markets delivered a weaker performance in

January 2026, contrasting sharply with the simultaneous

correction in equity markets. Bond yields hardened

across the curve as concerns over elevated government

borrowing, tightening system liquidity, and shifting global

capital flows outweighed the Reserve Bank of India’s

liquidity support measures. Despite debt’s traditional

safe-haven appeal, supply-side pressures capped price

gains and pushed yields to multi-month highs.

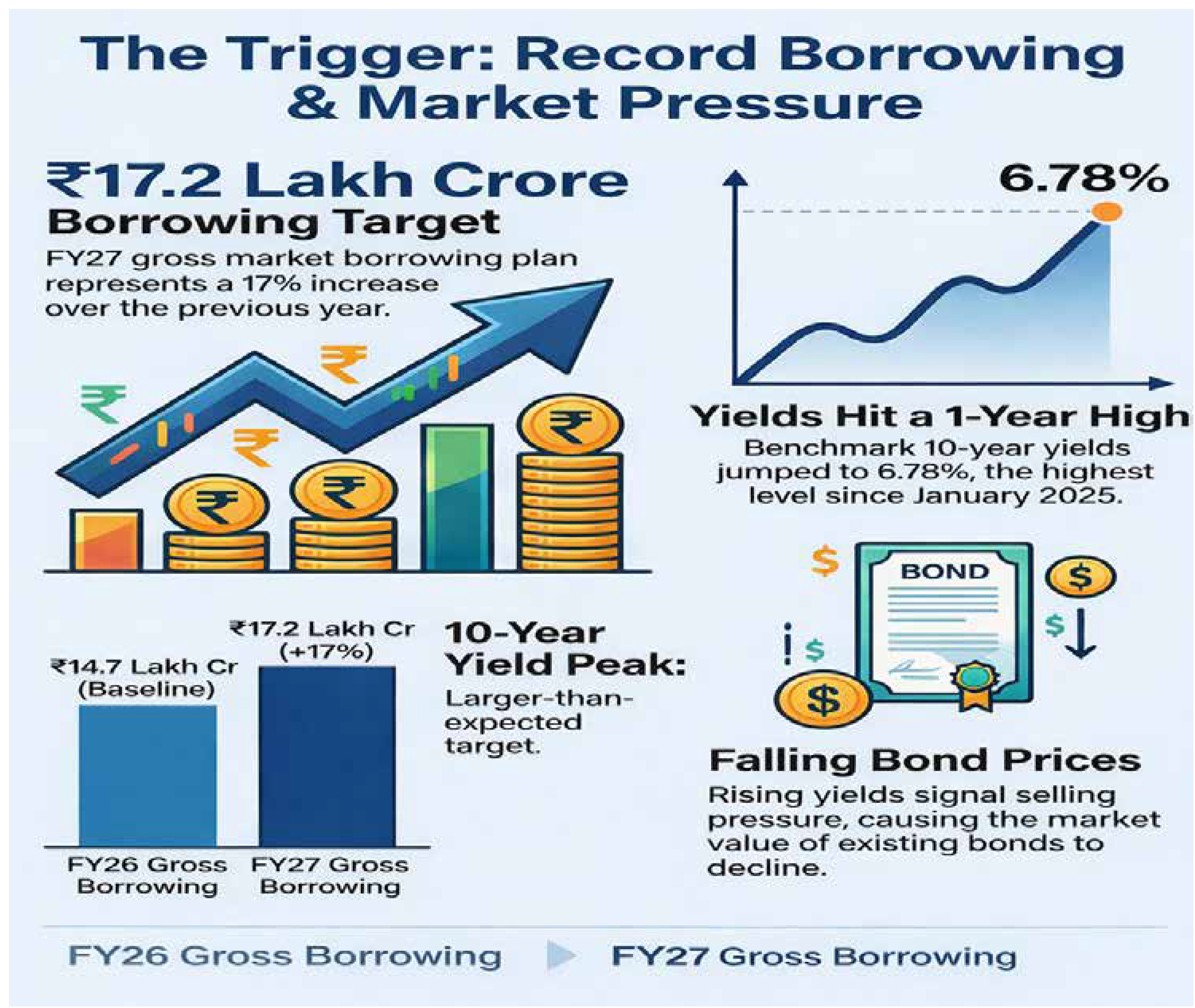

The most notable development during the month was the

sharp upward movement in sovereign bond yields. The

benchmark 10-year government security yield rose by

approximately 25–40 basis points from early January

lows of around 6.5%, touching an 11-month high of 6.72%

by the end of the month. The move was driven largely by

expectations of significantly higher borrowing by both

the central and state governments in the upcoming fiscal

years.

Corporate bond yields also edged higher, rising between

3 and 28 basis points across tenors as spreads widened

modestly amid cautious demand. In contrast, very

short-term rates showed mixed trends. Overnight

interbank call money rates eased briefly to around 5.30%

due to RBI liquidity injections, though volatility persisted

at the short end of the curve. A key factor weighing on

bond markets was the anticipated surge in government

borrowing. Pre-Budget signals and market estimates

suggested gross market borrowing of approximately

₹15.6 lakh crore for the central government in FY26-27,

with additional borrowing by states pushing total supply

pressure close to ₹30 trillion. This scale of issuance

raised concerns about the market’s ability to absorb

supply without higher yield premiums. Auction dynamics

reflected this stress. While Treasury bills continued to

see healthy demand, longer-tenor government securities

witnessed tepid bidding, forcing yields higher. Historical

trends suggest that large state borrowing

calendars—estimated at nearly ₹10.2 trillion—often

correlate with 20–50 basis point increases in benchmark

yields, a pattern that began to play out during the month.

Liquidity conditions further compounded pressure on

debt markets. Banking system liquidity remained in

deficit, driven by sluggish deposit growth of 10.7%

year-on-year compared with credit growth of 11.5%.

Additionally, RBI’s foreign exchange

interventions—estimated at nearly $30 billion—to

stabilize the rupee drained systemic liquidity and

reduced surplus reserves. Regulatory and accounting

changes prompted banks to conserve cash, pushing

one-year certificate of deposit (CD) yields up to 7.20%,

notably above the policy repo rate of 6.25%. Call money

rates intermittently spiked to 6.45%. The RBI responded

with variable rate reverse repo (VRRR) auctions totalling

nearly ₹1 trillion and conducted open market operations

(OMOs) worth about ₹2.6 trillion. While these measures

provided temporary relief at the short end, they were

insufficient to offset medium- and long-term supply

concerns.

Foreign portfolio investors (FPIs) shifted stance during

January, becoming net sellers of Indian debt to the tune

of approximately $1.5 billion—the first monthly outflow

since June 2025. Rising global bond yields, particularly US

10-year Treasuries offering yields near 4.8%, improved the

relative attractiveness of developed market debt.

Meanwhile, India’s real yields compressed to around 1.8%,

reducing carry appeal at the margin.

Despite January’s outflows, year-to-date debt inflows

remained positive at $6.16 billion, supported by longer-term

confidence in India’s macro stability. Within the domestic

market, FPIs showed a preference for high-quality AAA

corporate bonds. Nonetheless, spreads widened by 5–10

basis points for AA and AAA issuers, and the BSE debt index

declined around 0.8% during the month. Additional

disappointment came from the absence of India’s

government bonds in the Bloomberg Emerging Market bond

index, with inclusion deferred to March. This delayed

potential inflows of nearly $3 billion. Globally, geopolitical

tensions, trade rhetoric from the US, and a weaker rupee

hovering near 86.2 per dollar increased hedging costs and added to investor caution. Although the RBI maintained a steady policy stance amid inflation near 5.5%, external pressures—including oil prices around $75 per barrel—indirectly tightened financial conditions. While debt markets offered relative safety compared to equities, which fell nearly 3% during the month, heavy supply limited the upside. Gilt funds managed modest gains of 0.2–0.5% as investors selectively played duration. Overall, January 2026 highlighted the vulnerability of Indian debt markets to supply shocks and global shifts in risk appetite. Despite proactive RBI support, elevated borrowing and liquidity constraints pushed yields higher. Until borrowing clarity improves and global volatility eases, bond markets are likely to remain range-bound with an upward bias in yields, favouring cautious duration strategies and high-quality credit exposure.