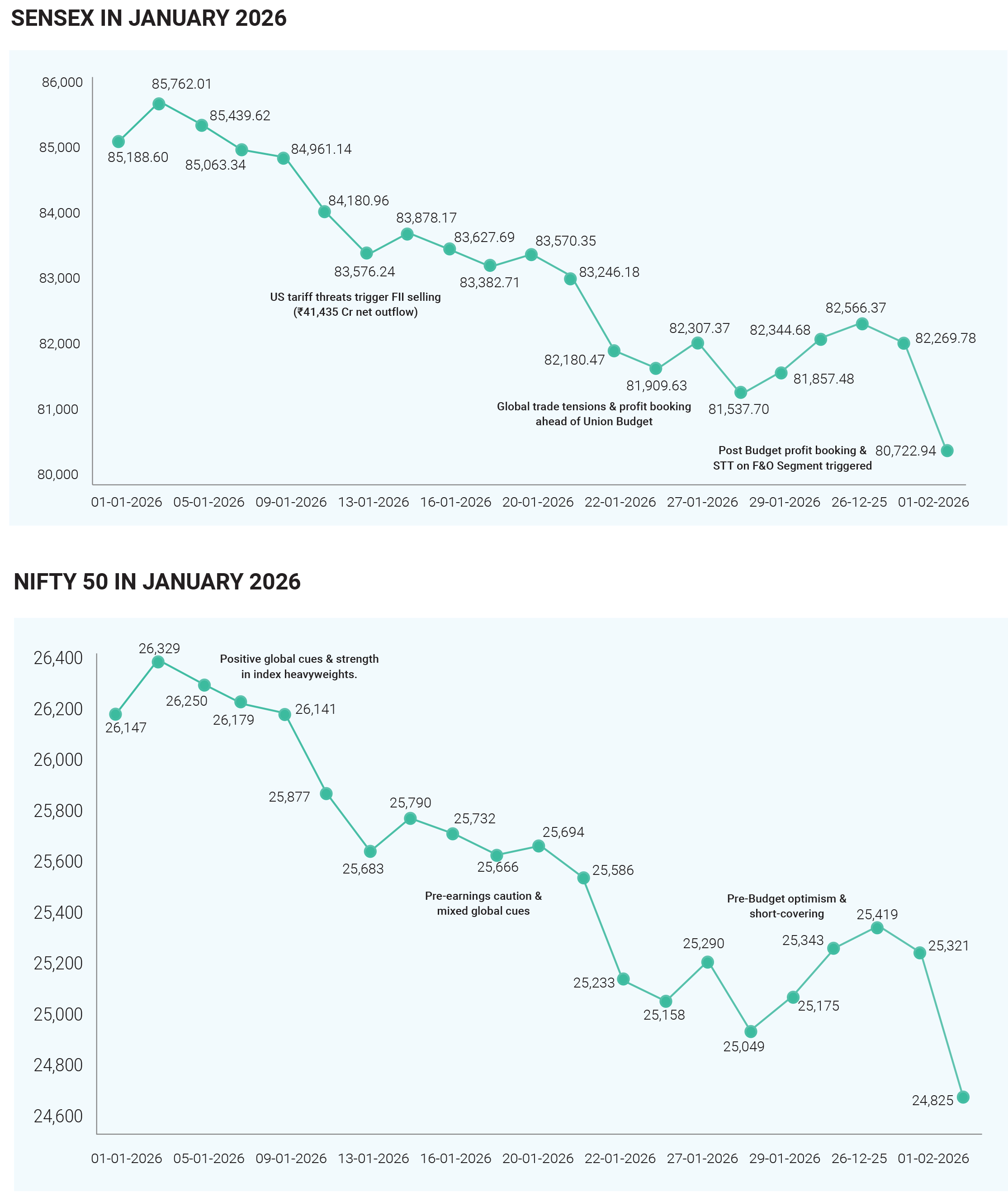

January 2026 proved to be a challenging month for

Indian equity markets, as a confluence of mixed

corporate earnings, unexpected tax changes, and

escalating geopolitical risks dampened investor

confidence. Benchmark indices such as the Sensex and

Nifty struggled to find direction, with volatility rising

sharply and sentiment turning cautious across both

domestic and foreign investors. While pockets of

strength emerged in select consumer stocks, they were

insufficient to counter broader macro and policy-related

headwinds.

The Q3 FY26 earnings season (for the quarter ended

December 2025 and largely reported in late January)

delivered an uneven picture. On the surface, headline

numbers appeared encouraging: aggregate revenue

across 1,096 listed companies grew 13.33% year-on-year

to ₹26.34 lakh crore, while net profit rose 11.32% to ₹2.79

lakh crore. However, the market’s reaction was driven

less by aggregate growth and more by

underperformance among heavyweight constituents of

the Sensex and Nifty. Several bellwether stocks

disappointed investors. Asian Paints reported a 4.6%

decline in net profit to ₹1,060 crore, citing weak urban

demand and persistent input cost pressures. Larsen &

Toubro saw its net profit fall 4.3% to ₹3,215 crore, largely

due to higher labour-related provisions and margin

compression in select infrastructure segments. These

earnings misses were particularly damaging because

such stocks carry significant index weight and are widely

held by institutional investors. The IT and automobile

sectors also lagged expectations. Global economic

uncertainty, slower discretionary spending in developed

markets, and elevated valuations weighed on IT stocks,

while auto manufacturers faced margin pressure from

higher costs and muted export demand. As a result,

rate-sensitive and cyclical sectors bore the brunt of

selling pressure during the month. There were, however,

a few bright spots. Tata Consumer Products reported a

strong 38% surge in net profit to ₹385 crore, driven by

steady volume growth and improved operating leverage.

Marico delivered a respectable 12% rise in profits,

supported by rural recovery and easing commodity

costs. Despite these positives, the broader market

narrative remained subdued, as gains in select FMCG

names failed to offset weakness in index heavyweights.

Overall, the earnings season reinforced concerns that

profit growth may be moderating just as valuations

remain stretched.

Compounding domestic concerns, global geopolitical

tensions intensified during the month, further unsettling

investors. The United States issued threats of imposing

tariffs as high as 100% on Indian exports in response to

India’s continued imports of Russian crude oil.

Simultaneously, instability in Venezuela and renewed

conflict involving Iran heightened fears of global energy

supply disruptions and inflationary pressures.

According to market participants, geopolitical factors

accounted for nearly 35% of the overall 3–3.5% decline

seen in Indian equity indices during January. The

uncertainty triggered a sharp rise in risk aversion, prompting heavy foreign institutional selling. FIIs were net sellers to the tune of ₹41,435 crore during the month, reversing some of the optimism seen toward the end of 2025. The rupee weakened beyond the psychologically important level of 86 against the US dollar, adding pressure on import-dependent sectors and stoking inflation concerns. Export-oriented sectors such as IT, pharmaceuticals, and metals also came under pressure due to fears of trade disruptions and slowing global demand. Market volatility surged as the India VIX spiked, reflecting heightened uncertainty and nervous positioning. Technically, the Nifty breached key support levels around 25,500, triggering algorithmic selling and stop-loss activations. While domestic institutional investors (DIIs) stepped in to absorb some of the selling and prevent deeper losses, their buying was not sufficient to spark a sustained recovery amid ongoing global risks Investor sentiment deteriorated sharply following the Union Budget presented on February 1, which introduced a significant hike in the Securities Transaction Tax (STT) on derivatives trading. The STT on futures contracts was doubled to 0.02%, while the tax on options trades was increased to 0.1%. Although aimed at curbing speculative excesses and boosting tax revenues, the move caught markets off guard. The immediate reaction was severe. On Budget Day, the Sensex plunged nearly 1,500 points and the Nifty fell close to 500 points, marking the sharpest single-day Budget-related decline in six years. Financial stocks and brokerage-linked counters led the fall, as higher transaction costs threatened to dent derivatives volumes—a segment that plays a crucial role in liquidity, price discovery, and foreign institutional investor (FII) participation. Market capitalisation erosion was swift, with an estimated ₹9.5 lakh crore wiped out in a single session. Analysts later estimated that nearly 20–25% of the market weakness observed in late January could be attributed to concerns surrounding the STT hike. Panic selling, especially in high-beta and leveraged positions, amplified the downside, while traders reassessed profitability in the derivatives-heavy trading environment. In summary, January 2026 underscored the fragile balance currently facing Indian equity markets. Mixed earnings from index heavyweights, an unexpected increase in trading taxes, and escalating geopolitical tensions combined to erode investor confidence and elevate volatility. For investors, the month served as a reminder of the importance of diversification, disciplined risk management, and a focus on quality businesses with strong balance sheets. As uncertainty lingers, markets may continue to reward selective stock-picking over broad-based index exposure in the months ahead.