When inflation is high and broad-based, with no sign of entrenchment,

central banks have only one tool to tackle rising prices: a hike in interest

rate. However, higher interest rates come with a price: economic

slowdown. As inflation in the US touches a decadal high, the US Fed is

stepping up its war against inflation with aggressive rate hikes. The 75-bps

rate hike in mid-June (highest in 28 years) was followed by another 75-bps

increase by end of July, as concerns about inflation trump worries about

growth.

However, as the markets believed the Fed’s tone had a dovish tilt, there

was a rally in the risky assets. Also, as the risk of recession grew louder

after the US economy contracted for the second consecutive quarter,

markets believed inflation measures will fall in place bringing an end to the

tightening cycle near.

While the market seems to believe that the Fed may slow down its rate

hikes, we doubt the narrative is that simple. There are several headwinds

such as the Russia-Ukraine crisis, geopolitical tension between China - Taiwan, and the lingering effect of covid itself, which all remain outside the

Fed’s control. Also, the labor markets remain strong, which lends support

to the idea that the US is not quite in a recession and that the Fed will

continue its path of interest rate hikes.

Given the magnitude of these unknowns, we believe the Fed will follow a

calibrated approach. They will look at almost 8-weeks of economic data

before their next meeting in September to decide on the magnitude of the

future rate hikes. While, the recent jobs data has restored the Fed’s

confidence in hiking rates sharply, the deflationary wave due to the

economic slow down in China could taint the Fed’s decision.

In the recent monetary policy, as expected the RBI hiked interest rates by

50 bps even though inflation has started to ease in India. An increase in

the rates was necessary to minimize the interest rate differential between

India and the US.

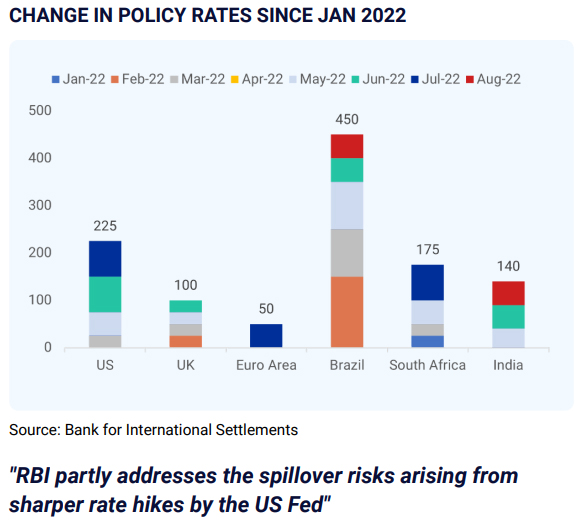

This year, the US Fed has hiked interest rates by a massive 225 bps, while

the RBI has just bumped up the rates by 90 bps (now 140 bps including

the recent hike). This increasing difference in the rates between the two

countries is one of the reasons foreign investors are pulling out money

from the Indian markets. This has also put pressure on our currency.

Given that the surplus liquidity in the banking system has tightened due to

the RBI’s intervention in the foreign exchange market to stabilize the rupee,

no measures were announced to suck out any liquidity.

Going forward, we expect inflation to hit below the 6% mark as the global

commodity prices are coming down. Also, we believe that the RBI shall

continue to follow the footsteps of the US Fed to avoid any major currency

volatility. Given the uncertainty with rate hikes and their magnitudes,

reduction in liquidity and substantial supply of government securities

coming up, bond yields are expected to remain under pressure. Also,

equity markets may fill jitters depending on any new upcoming data in

either the US or India.

WE LIKE 6 THEMES IN THE CURRENT MARKET ENVIRONMENT

1. Smallcap Growth Companies:

Smallcap growth stocks were punished severely over the last 9 months due to rising inflation as their future earnings growth was discounted more.

However, if inflation is coming down, this trend should reverse

2. Ukraine War Relative Winners:

We have two subthemes to play Ukraine War relative winners:

- Defense: The Ukraine conflict is causing a huge spike in defense spending around the world and arms manufacturers will be the winners

- Country Winners: While US consumers are getting hurt from rising commodity and energy prices (like all consumers around the world), their stock contains many companies that benefit from it. The US is either self-sufficient or a net exporter of energy and most commodities. Furthermore, it has little exposure by way of trade with either Russia or Ukraine

3. Tech Winners:

We have 3 subthemes to play Tech Winners:

- Semiconductors: Semiconductors are essential to most electronics. Their demand is skyrocketing while supply chain disruptions are increasing

- Cybersecurity: Cyber-attacks on enemy infrastructure are a big part of modern warfare and countries are strengthening their defenses against such attacks. Cybersecurity software developers will be the winners

- Mega Cap Growth: Mega Cap Growth stocks with high percentage holdings in tech giants such as Apple/Google/Amazon and Microsoft, with their dominant positions and established supply chains are expected to weather the current market uncertainties the best

4. Infrastructure Spending: Countries across the world are investing in their infrastructure to stay competitive. Global warming trends suggest that this spending may accelerate

5. Recession Risk Winners: In a recessionary or a slow-growth environment, consumer staples and healthcare perform the best

6. Oil: While many commodities have sold off, including Oil, the underlying dynamics of Oil supply and demand point to a prolonged period of higher prices

Choosing the right mutual fund is one of the most critical and challenging decisions an investor/advisor must make. Our focus here is on ‘choosing right’

over ‘choosing the best performing’ as we believe it would be impossible for anyone to predict the best performing mutual funds consistently.

The question then arises which are the right mutual funds to be considered for investing. We follow the analytical approach for recommending funds,

focusing on three tenets viz. past performance, the manager’s ability to identify trends in the market, and their stock-picking ability. We perform the entire

process of fund selection every quarter to check for any deviation in our recommended funds.

The table below lists our recommended funds across different categories based on the March-end data.

|

Mutual Fund Ranking |

Quarter Rank |

Final Rank |

||

|

Quant |

Skill |

Sector Contribution |

||

|

Large cap (total 27 funds) |

||||

|

Axis Bluechip Fund-Reg(G) |

2 |

2 |

1 |

2 |

|

Mirae Asset Large Cap Fund-Reg(G) |

3 |

1 |

1 |

4 |

|

Canara Rob Bluechip Equity Fund-Reg(G) |

2 |

2 |

4 |

9 |

|

|

|

|

|

|

|

Multicap with Large cap bias (total 34 funds) |

||||

|

JM Flexicap Fund-Reg(G) |

2 |

1 |

1 |

1 |

|

Sundaram Focused Fund(G) |

2 |

1 |

3 |

5 |

|

Axis Focused 25 Fund-Reg(G) |

3 |

2 |

1 |

7 |

|

UTI Dividend Yield Fund-Reg(G) |

2 |

2 |

4 |

11 |

|

DSP Flexi Cap Fund-Reg(G)* |

3 |

4 |

2 |

26 |

|

|

|

|

|

|

|

Multicap (total 47 funds) |

||||

|

Parag Parikh Flexi Cap Fund-Reg(G) |

1 |

1 |

1 |

1 |

|

Mirae Asset Emerging Bluechip-Reg(G) |

2 |

1 |

1 |

2 |

|

SBI Focused Equity Fund-Reg(G) |

2 |

2 |

1 |

3 |

|

Nippon India Focused Equity Fund(G) |

3 |

2 |

1 |

8 |

|

Kotak Equity Opp Fund(G) |

3 |

1 |

3 |

17 |

|

|

|

|

|

|

|

Midcap (total 21 funds) |

||||

|

Axis Midcap Fund-Reg(G) |

1 |

1 |

2 |

1 |

|

DSP Midcap Fund-Reg(G) |

2 |

2 |

3 |

3 |

|

Invesco India Midcap Fund(G) |

2 |

3 |

4 |

12 |

|

|

|

|

|

|

|

Small cap (total 14 funds) |

||||

|

Union Small Cap Fund-Reg(G) |

2 |

1 |

2 |

2 |

|

Axis Small Cap Fund-Reg(G) |

2 |

1 |

2 |

2 |

|

|

|

|

|

|

|

ELSS (total 34 funds) |

||||

|

Mirae Asset Tax Saver Fund-Reg(G) |

2 |

1 |

1 |

1 |

|

Axis Long Term Equity Fund-Reg(G) |

2 |

2 |

1 |

2 |

|

Baroda BNP Paribas ELSS Fund-Reg(G) |

2 |

2 |

1 |

2 |

|

Motilal Oswal Long Term Equity Fund-Reg(G) |

3 |

3 |

1 |

13 |

|

Canara Rob Equity Tax Saver Fund-Reg(G)* |

2 |

3 |

4 |

21 |

After being in review for couple of quarters, LIC MF Large & Midcap Fund-Reg(G) has been removed from the list of recommended funds

Copyright © 2021 Fintso